Now you have set-up your AutoPay for paying off your credit cards, as you probably did in this guide I made for you, you can now slowly work on your FICO-score.

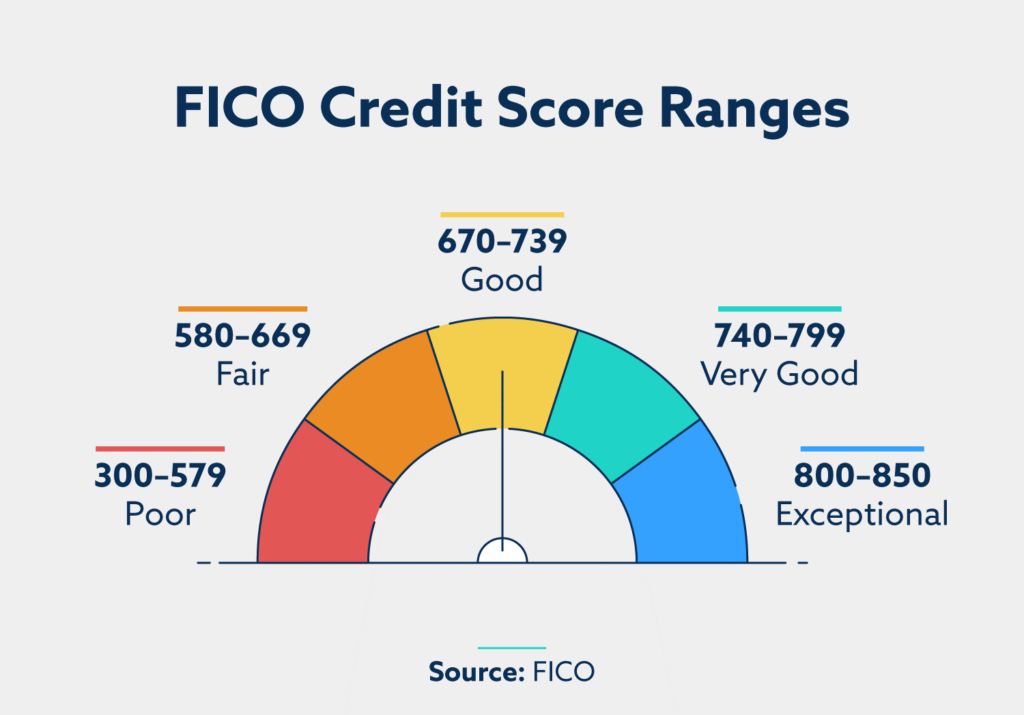

Your FICO-score is your American financial heartbeat. The higher your FICO-score is, the more reliable you are and the easier you get approved for other credit cards in the future.

There are a lot of factors which come into play when, calculating your FICO-score, but since you probably (just like me) are a non-resident alien, your instructions are pretty simple. US Citizens have more factors to take into account, since they probably have mortgages, car loans, study debt, ect. We as ‘non-resident aliens’ probably don’t have any of those 🙂

But still you can work on your FICO-score by applying these rules:

1. Pay

There are three important things to get your FICO-score taking off:

-

- Pay your credit card statement on time.

- Pay your credit card statement on time.

- Pay your credit card statement on time. Remember setting up AutoPay? 😉

2. Be patient.

Since you don’t have a Social Security Number (SSN) or International Tax Identification Number (ITIN), you are really a complete unknown alien to the FICO-organization.

Hence; FICO needs about six months to get a picture of you. FICO is doing this, by checking your account health every month with your card issuers. Again, in my case American Express and Bank of America. And again, remember setting up AutoPay? 😉

3. Stay below the radar for the first months

Be thankful and happy with just one or two credit cards to start with, and work on using these ones in a responsible way first. Do not apply for any new credit card. Not via the issuer you are already a client with, not with a new issuer. Just keep your cool for a while. At least, until those six months have passed and you have at least been notified of your FICO-score for the first time.

4. Spend responsibly

Having a credit card and not spending on it, is not good for your FICO-score. But maximizing the credit on your card is also a bad idea. Try to find a balance by utilizing your credit per card between the 20%-80% of your limit.

You need some spending, to show that you can pay of your monthly statement. On the other hand, you also don’t want to max out your credit.

If you want to hit the treshold for your sign-up bonus, let’s say 3000 USD in six months, don’t do that by one big 3000 USD easy purchase, such as a hotel or business class airplane ticket. Instead, try to spend 500 USD or 1000 USD per month for the first six months.

However, if there is an emergency, like you are abroad and need to get the first plane home because of family reasons, and the only option is an expensive airplane ticket, you can still use your card to the maximum credit you have. But as soon as you land back home, make a pro-active payment to your card in order to pay this big debt off even before your monthly statement has been issued to you.

By doing this, you indeed maxed out the credit on your card, but you showed the issuer that you use it responsibly.

What’s up next?

If you sticked to these rules, your first FICO-score should be at least good after six months. Between 670-739.

I still strongly do not suggest that you now apply for any new cards yet. Still give it a few months (three to six) to see if your FICO-score changes after that.

After about one year, you can slowly request other credit cards if you want, but try to stick to maximum two new credit cards per year.

FICO-scores changes monthly and it’s a really slow process. The longer you have your bank/credit card accounts open, the more reliable you get, and the smaller the monthly changes are. Especially the first months, you can swing heavily from a low scores to a high scores, with very little impact.

The longer your history is, the smaller those impacts are on your FICO-score.

Conclusion

I hope you liked this article and I surely hope I saved you a lot of time and homework 🙂

This blog is completely free, I am just an individual, there is no company behind this page. I try to get some revenue from the Google Ads (as you proably noticed), but the best way to help me is by using my affiliate links:

Anveo.com for the US cell phone number. I receive 10% of the funds you deposit with them.

American Express referral link: You receive up to 40.000 AMEX reward points when approved. I receive 10.000 AMEX reward points as referral for every new customer.