You probably landed on this page because you are looking for an American credit card, but you are lacking a Social Security Number (SSN) or International Tax Identification Number (ITIN), and you are not an US-resident.

Since I had exactly the same problem, I decided to make a manual which, at least for me, worked out pretty well!

Unfortunately, on the web, you can only find articles from travelbloggers who are trying to sell you credit cards from their American point of view.

It took me about a full weekend to combine several blogs, YouTube-videos, Reddit- and Flyertalk-Forum posts, to finally find out that there actually is a scenic route to obtain an US credit card with all cool benefits, even if you are a non-resident and you are not able to provide an SSN or ITIN. Let me share my story with you!

The reason why you want an American credit card

Obviously: benefits! Credit cards in de United States come with huge benefits and even better sign-up bonusses. The disadvantage: if you miss a payment, American credit card companies are allowed to charge you with heavy interest, starting form 22%!

Under European law, interest which financial institutions are allowed to charge is capped on (I believe) 12%. Due to this restriction, American credit card companies have no desire to offer their product to the European market.

Unlike in Europe, you will most probably get one credit/point/mile for every euro spend on your European credit card. With American credit cards you can hit multipliers of at least three, and sometimes even up to ten! Besides that, transfer partners in Europe usually give you a 3:1-ratio when transfering American Express Rewards points to airline or hotel programs. With American credit cards the transfer ratio is normally 1:1.

And last but not least, American credit cards sometimes even will bump you to the next level in a loyalty program!

So if you really want to enjoy all the benefits which come with American credit cards, and you live in Europe, you have to do your homework in order to get approved.

Lucky for you: I already did part of the job for you 😉

My starting point to get approved as a non-resident

Nationality: Dutch

Passport: Dutch

Living in: The Netherlands

United States Visa/Green card: None

United States Social Security Number (SSN): No, only a Dutch SSN.

United States International Tax Identification Number (ITIN): No, only a Dutch Tax ID.

ESTA: yes

US FICO-score: non-existing

Current Dutch credit cards: Mastercard (via a Dutch Bank), Visa (via Revolut), American Express Personal Green Card

Family/relatives living in the United States: none

Employment status: self-employed in The Netherlands

Things for you are much easier if you are willing to get an United States ITIN, but I was not interested in registering myself with the IRS. Obtaining an ITIN as a non-resident is not impossible, but takes you about twelve weeks. Search on Google if you prefer the ITIN-route 🙂 Below I will continue with the non-ITIN-route.

Step-by-step guide to obtain an American credit card as non-resident

- Get a physical address

- Get a US-cell phone number

- Get a US bank account

- Do a ‘Global Transfer’ with American Express

- Or, get even approved for a real credit card via your US bank.

- Or, get a ‘secured’ credit card via your US bank

As you can see, step 1, 2 and 3, are mandatory. Step 4, 5 and 6, depend on your personal situation.

You can do almost everything online, except for step 3 and step 5/6. Ergo: you really need to visit the United States at least one time for this project.

I was lucky that for step 3 and 6, I was able to plan something for my work in the United States, so I made two trips to the United states, but one trip should be sufficient.

Step 1: Get a physical address

Ok, here we go! First, you need a physical address in the United States. Financial institutions obligate you to have a residential address in the USA. They will not send documentation and/or the physical bank card / credit cards to your local (international) home address.

You can use an address of an American friend/family/relative, but I didn’t had anyone, so I was forced to us a ‘virtual office’.

Eventually I selected: https://physicaladdress.com/locations/

But be aware! Only the Wilmington-location is suitable for you! Their Wilmington-location is a ‘residential’ one. All their other locations are registered as commercial mail receiving agency (CMRA). And financial institution will not accept a commercial address.

I started with a montly subscription first. Simply to check it out and to see if it worked. After I finally received my credit cards in the Netherlands, I switched to an annual subscription, which is 20% cheaper than the montly subscription.

I believe there is about 20 content scans included, so once your bank / credit cards arrives at your Wilmington address, you can request a free scan of the content and you can at least start with using your credit card number for online purchases already.

Mail forwarding is not included in your subscription. For every shipment I paid about an additional 20 USD with a standard-FedEx postal service. Every shipment took about 7-10 days before the forwarded mail arrived on my home address in the Netherlands.

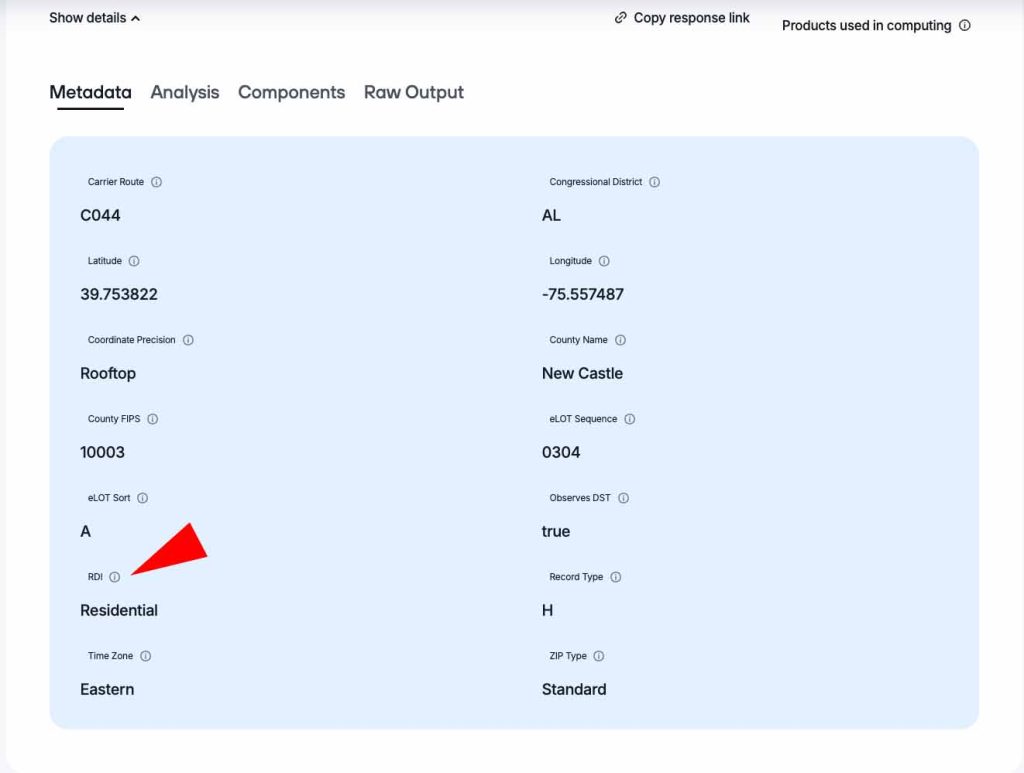

Of course, feel free to select another provider of physical addresses. You can check the ‘residential’-status via this tool: https://www.smarty.com/products/single-address.

Enter your address and click on the ‘show details’ button. The page will expand and you can check the RDI-indicator.

Once you have created your account with PhysicalAddress.com, they offer you for about 25 USD to register your new address via a notary. This is needed for all United States mailing companies to get you ‘recognized’. Normally your city council would register you automatically when you are going to rent or buy an house in their municipality, but since your are a ‘non resident alien’, the mailing companies need this as an alternative.

But don’t worry, PhysicalAddress.com partnered with the company Notarycam.com for remote and online video registration. You pay the 25 USD-fee, and in a 10-15 minute video call session, a Notarycam-employee fills in this form for you: https://about.usps.com/forms/ps1583.pdf.

During this short video-call, the Notarycam-employee also verifies your local address in your home country and your passport details.

After this is done, you have completed step 1 🙂

Step 2: Get a US-cell phone number

Now you need to get a American registered mobile phone number. While this is not mandatory for banks to call you, you need it for ’two-factor-verification’-login to your future US bank account and credit card company account.

There are several options to obtain an US registered number, such as E-sims, or prepaid telephone cards with sim cards. You can buy prepaid simcards when you are visiting the United States, or simply buy it online on Amazon for example and get it shipped to your home country.

However, I found a much cheaper option via Anveo.com. I have to admit, it looks very back-to-the-nineties, but it works like a charm!

To make things not too complicated, I simply selected a Wilmington-based mobile number and funded my new Anveo-account with 15 USD.

Update September 2025: There used to be a one-time administration fee to get your number issued, which is about 5 USD, after that you pay-as-you-go. For every received text message, 0,10 USD is deducted from your account.

Currently the one-time administration fee has been waived now, but in exchange Anveo.com, is charging 0.75 USD per month for the ‘hosting’ of your number. Still a steal in my opinion!

Anveo.com offers other subscriptions and more features, but for this purpose, my setup is working fine!

I tried to get text messages forward to my Dutch cell phone number, but unfortunately these messages didn’t came through. When you need to use a ‘verification code’, you have to login on the Anveo-website and navigate to your Inbox to copy-paste the ‘verification code’. A bit of a work around, but again: it works!

Step 3: Get a US bank account

Right! We have an US residential address, we have an US cell phone number. Now we need an US bank account!

This is the moment when you physically have to go to the United States.

There are a few banks which allow non-residents without a SSN and/or ITIN to open a bank account. As far as I know, Capitol One and Bank of America (BofA), besides a few others, accept non-residents.

Since the BofA branch office was in front of my hotel when I was in the United States, I opted for BofA.

I simply walked in without an appointment, but the risk is that you have to wait for a more senior banker to help you. I was lucky, it was not busy during my visit to this BofA branch office, and a senior banker was available right away.

It takes less than 30 minutes, and the banker asks you a few basic questions. The more documents you have prepared, the better.

This is what got me accepted as client:

-My Dutch Passport

-My Dutch driving license. (BofA needs two photo-ID’s)

-An e-mail address

-Your newly created US cell phone number. (For two-factor-verification)

-A proof of address of my Dutch address. This can be an energy bill, bank account statement. Anything with your name and address on it.

-A proof of address of your US address.

This is where it gets complicated. Because my Wilmington-address is just a post box, and obviously I was unable to provide any document. But a fake rental agreement will do the job. You can ask ChatGPT to generate one. Instead I used this template provided by YouTuber James Baker. All credits to him of course!

I completed this template with my Wilmington address, and a fake name, address and signature of a landlord. Simply use a neighbouring address for your landlord, so it looks like you are renting the appartment next door or the floor below 😉

Don’t forget to use two different colored pencils to undersign the lease agreement. For example a black color for the landlord and your own signature in blue. This makes it more credible 😉

As monthly leasing price I entered 1.850 USD per month, which is reasonable for Wilmington. This amount is just under 40% of my monthly income. And this is important for your credit card approval. If you pay too much for your rent with reference to your salary, credit card companies will reject you because you could be a finanacial risk to them.

The crazy thing is, nobody every checked my leasing agreement or even salary! The banker only checked the first page of my leasing agreement, to enter the Wilmington address in his system!

Once the banker is done with the administration, you only have make a cash deposit of 100 USD. I deposited a bit more: 500 USD, because that’s the treshold to avoid monthly maintenance fees.

30 minutes later, I walked out of the branch office and I was a client of BofA.

After about a week my BofA debit card with all documentation was available at my Wilmington address. I instructed PhysicalAddress.com to forward this package to me in the Netherlands, and FedEx did so about a week later.

Just to be sure and better safe than sorry, I used my card for a few transactions in that first month. After this first month, I was able to provide the financial institution with a recent ‘proof of address’ of my Wilmington address, if they would have requested it.

Step 4: Do a ‘Global Transfer’ with American Express

This step only applies to you if you already have an American Express card in your home country. Or if you don’t haven an American Express card yet, but if you are a citizen of Australia, Brazil, Canada, the Dominican Republic, India, Kenya, Mexico, Nigeria, Philippines, South Korea, Switzerland or the United Kingdom. If not, you can skip this step and proceed to step 5 or even step 6.

Luckily I am already a Dutch American Express-client for about 15 years, and never ever missed a payment. Therefore I am a reliable client to them 🙂

Navigate to the US American Express website and select the card you prefer. I suggest you start with the most simple and cheapest one, this makes it easier to upgrade after three or six months, and receive another bonus (cashback or reward for example).

I selected the American Express Green Card, and I suggest you do so as well, since this is a good card to start with. (And if you like my content and want to help me, please use this referral URL so I receive some bonus points).

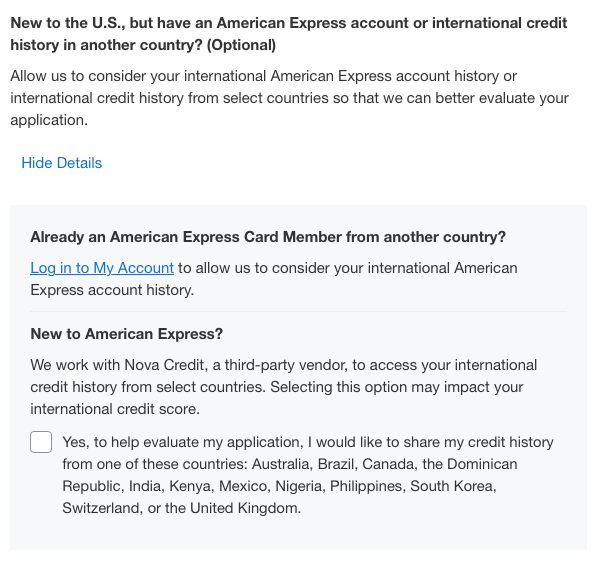

During your application you have two options (see screeshot below):

- If you already are an American Express-client in your home country: Log in to your account in your home country, and the American United States website simply imports all your data.

- If you are not an American Express-client in your home country, but if you are a citizen of the countries previously mentioned, you can allow third party vendor Nova Credit, to do a credit check on you to get you approved with a bit of a detour.

I obviously selected option one. The US website imported my data and now I simply had to wait. After about three days, I received a call on my Dutch phone number from American Express United States. They asked me some verifcation questions, and I was approved!

Again, about a week later my new US American Express credit card was delivered to my address in Wilmington, and another week later FedEx delivered the card to my Dutch home address.

Step 5: Get approved for a real credit card via your US bank

Did step 4 not work, or are you not interested in the service provided by Nova Credit, then step 5 is your other option.

Since I was already a ‘known customer’ with BofA, I was able to apply for a credit card directly with them. As a non-resident without SSN or ITIN, I was not able to this online or over the phone, but again, I had to visit a BofA-branch office.

In hindsight, I could have applied for a credit card at the moment I opened my BofA bank account. That would have been much easier, but I it didn’t cross my mind. During my first BofA branch office visit I was already overexcited that I was able to get a bank account after all 🙂

Anyways! You have to visit the United States (again) and physically go to a BofA branch office again. Unlike for setting up a new bank account, for credit card applications you don’t need to make an appointment or wait for a senior banker. Junior bankers can do the job.

Again, you have to provide your ID (my Dutch passport), your BofA debit card, and tell which card you want. Inform the banker of your monthy salary, and your monthly home expenses (remember the leasing agreement in step 3?). This all takes about 10-15 minutes.

Instantly the computersystem tells the banker if you are approved or not, and what your credit line is. Most common is that you start with 500 USD credit line on your card, which can increase after a few months if you pay on time. (I strongly recommend you apply ‘auto pay’ to your credit cards to avoid late fees and increase your FICO-score faster).

To my surprise I even got a 4000 USD credit line 😱. I selected the Air France KLM Flying Blue World Elite Mastercard:

After a week, again, my new credit card was delivered in Wilmington and again, FedEx delivered it for about 20 USD to my Dutch home address.

I got approved, but there is always a small chance that your bank will reject you for a credit card. In that case, you proceed to step 6.

Step 6: Get a ‘secured’ credit card via your US bank

Most probably, if you are being rejected for a credit card in branch office of your bank, the banker will offer you a ‘secured’ credit card. This is simply said, a prepaid credit card, which you fund from your normal US bank account.

A secured credit card doesn’t give you all the benefits (yet) which normal credit card do, but, it will help you build a credit profile and increase you FICO-score.

Basically everybody can get a secured credit card! There is simply no risk to the issuing bank/provider, since you pre-fund it with your own money anyway.

Normally, after about six months of using your secured credit card, your FICO-score has most probably reached 670, which makes you eligible for a credit card application.

FICO scores range from 300 to 850. The higher the better.

If you have loads of debt, are unemployed, etc, your score will most likely be on the 300 side. If you have a steady income, pay your credit card bills on time (remember auto pay?), and your spending is in relation to your income, your score will most likely move to the 850 direction.

For reference: Only 1,5% of the US population has a 850 score, the happy few 😉

You just need to be between 670 and 800, where 720-760 is pretty average.

Conclusion

To summarize this very long guide (sorry!); you have to spend some money on third party providers to get yourself setup. You need to visit the United States at least one time. And you need to have some patience.

I personally got my bank account, my US American Express credit card, and BofA Flying Blue credit card, within 90 days. I could have done it a bit faster if I applied for a credit card when creating my bank account. If all stars are alligned, you can get the job done within 60 days.

I hope you liked this article and I surely hope I saved you a lot of time and homework 🙂

This blog is completely free, I am just an individual, there is no company behind this page. I try to get some revenue from the Google Ads (as you proably noticed), but the best way to help me is by using my affiliate links:

Anveo.com for the US cell phone number. I receive 10% of the funds you deposit with them.

American Express referral link: You receive up to 40.000 AMEX reward points when approved. I receive 10.000 AMEX reward points as referral for every new customer.

My result:

Continue reading:

Setting up AutoPay to increase your FICO-score